INVESTMENT PHILOSOPHY

The Weight of Evidence

© 2011 Behavior Gap

“The important thing about an investment philosophy is that you have one you can stick with.”

- David G. Booth

Pursuing A Better Investment Experience

Key Principles to Improve Your Odds of Success

2. Don’t Try to Outguess the Market

The market’s pricing power works against fund managers who try to outperform through stock picking or market timing. As evidence, only 18% of US-domiciled equity funds and 15% of fixed interest funds have survived and outperformed their benchmarks over the past 20 years.

3. Resist Chasing Past Performance

Some investors select funds based on their past returns. Yet, past performance offers little insight into a fund’s future returns. For example, most funds in the top quartile of previous five-year returns did not maintain a top-quartile ranking in the following five years.

Past performance is no guarantee of future results. Indices are not available for direct investment.

Index performance does not reflect the expenses associated with the management of an actual portfolio.

10. Focus on What You Can Control

A financial advisor can offer expertise and guidance to help you focus on actions that add value. This can lead to a better investment experience.

- Create an investment plan to fit your needs and risk tolerance.

- Structure a portfolio along the dimensions of expected returns.

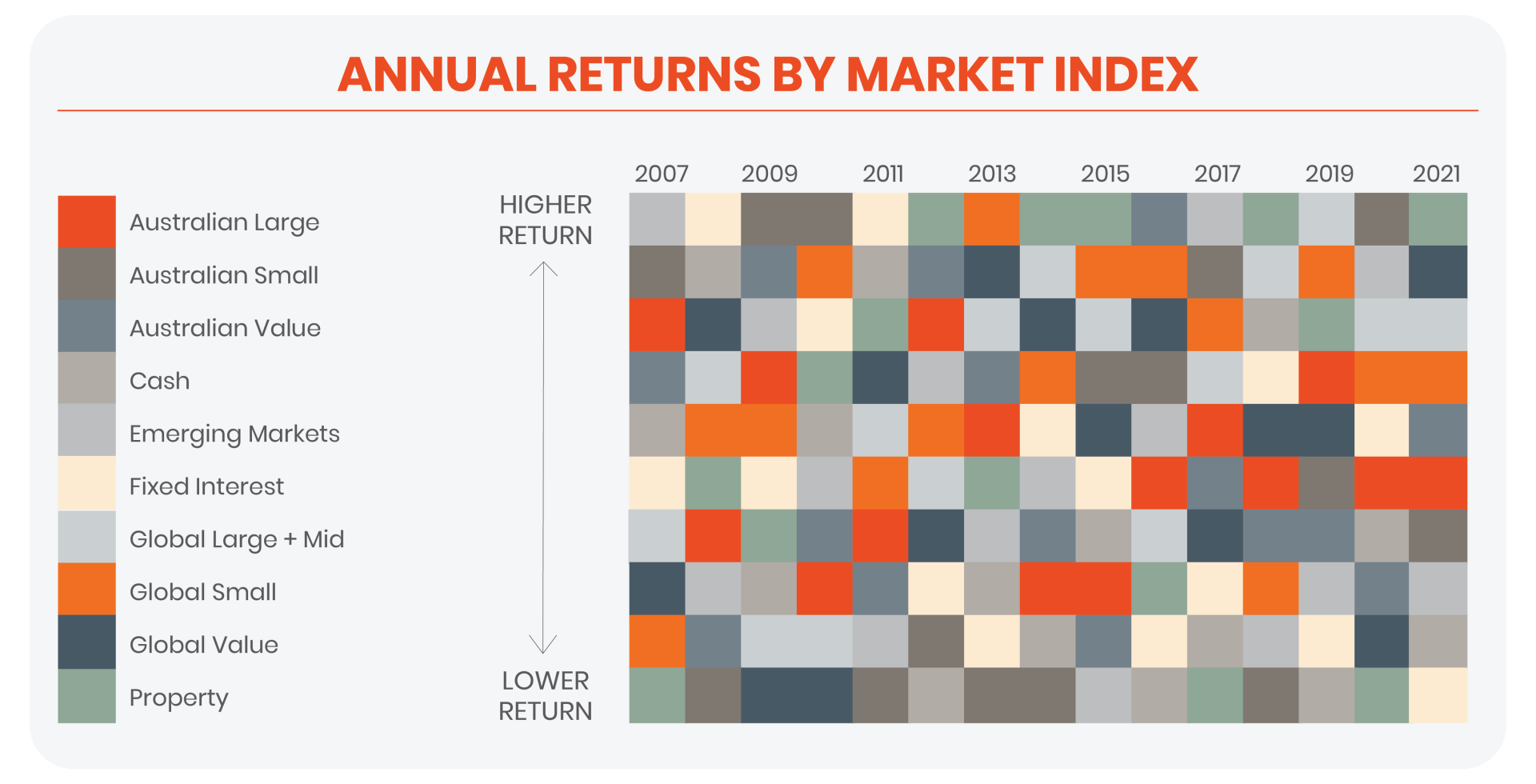

- Diversify globally.

- Manage expenses, turnover and taxes.

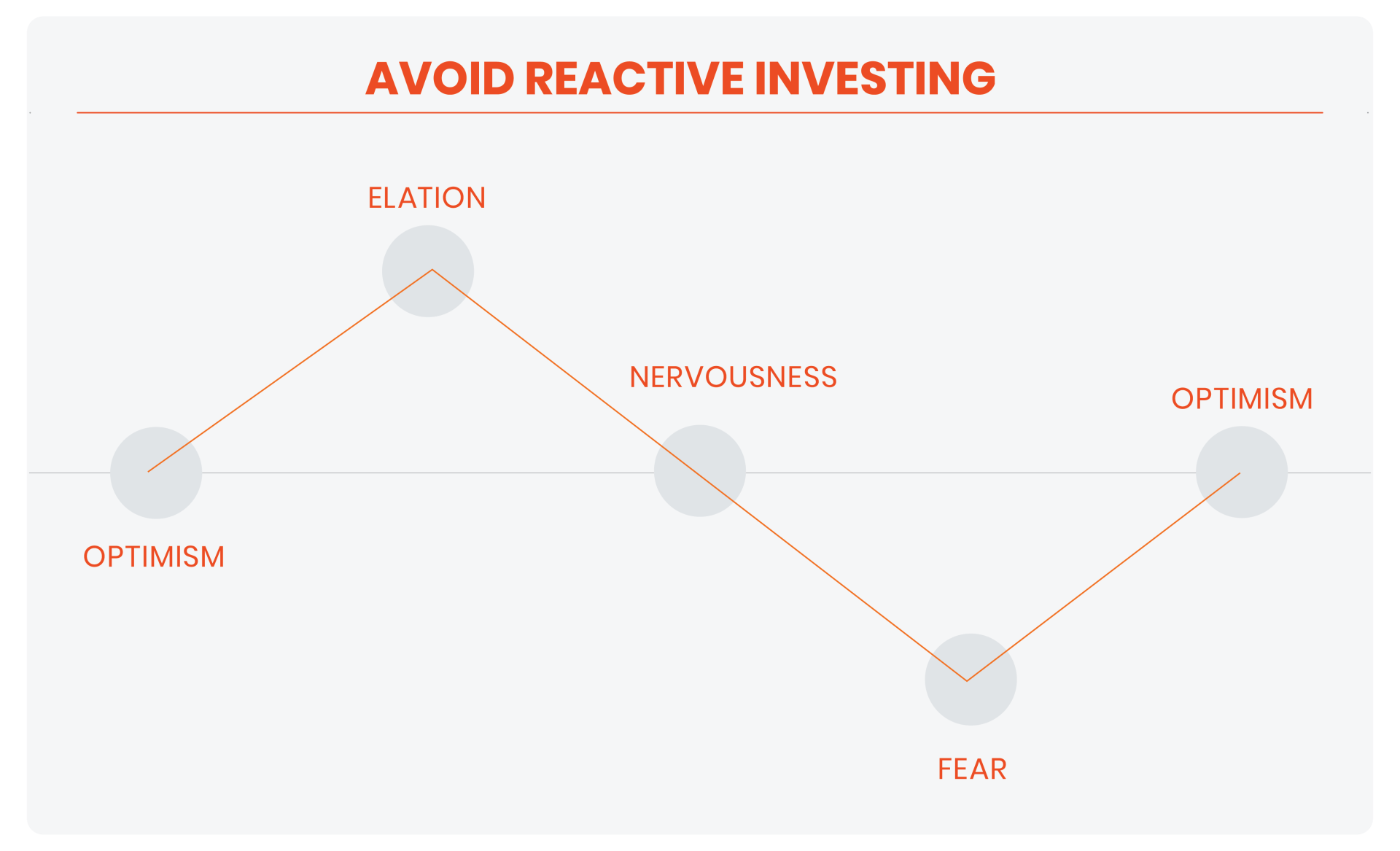

- Stay disciplined through market dips and swings.

Diversification does not eliminate the risk of market loss. There is no guarantee investment strategies will be successful.

This information is for illustrative purposes only.

Shining the Light on Your Financial Future

Valo Wealth is committed to guiding you on your journey through an ever-changing landscape. With our unique approach to financial services, we aim to give you the clarity you need to make good financial decisions.